unvs.ru

Market

Which Is More Expensive Gold Or Silver

Gold has been considered more valuable than silver throughout modern history. As I write this blog, an ounce of gold costs over seventy-five times more than an. Live Spot Prices for Gold, Silver, Platinum, Palladium and Rhodium in ounces, grams, kilos and tolas in all major currencies. Silver Is Currently Cheaper than Gold Per ounce, silver tends to be cheaper than gold, making it more accessible to small retail investors who wish to own the. as silver. What are rose gold's advantages? One of rose gold's best advantages This scarcity makes platinum more expensive than gold most of the time. One of the main reasons why silver is cheaper than gold is the rarity of the metal. There is much less gold available in the world than there is silver. Stay updated with the latest real-time prices for gold, silver, platinum, and palladium. Access historical charts, market trends, and investment tips at. As I write this blog, an ounce of gold costs over seventy-five times more than an equal weight of silver. Why the huge difference? So why does gold demand a premium value over these other metals? What's the opportunity trading gold vs silver? Surprisingly, it is the fact gold is so. Gold is more expensive than platinum, yet we perceive platinum levels as more prestigious. Historically, gold and platinum have been very. Gold has been considered more valuable than silver throughout modern history. As I write this blog, an ounce of gold costs over seventy-five times more than an. Live Spot Prices for Gold, Silver, Platinum, Palladium and Rhodium in ounces, grams, kilos and tolas in all major currencies. Silver Is Currently Cheaper than Gold Per ounce, silver tends to be cheaper than gold, making it more accessible to small retail investors who wish to own the. as silver. What are rose gold's advantages? One of rose gold's best advantages This scarcity makes platinum more expensive than gold most of the time. One of the main reasons why silver is cheaper than gold is the rarity of the metal. There is much less gold available in the world than there is silver. Stay updated with the latest real-time prices for gold, silver, platinum, and palladium. Access historical charts, market trends, and investment tips at. As I write this blog, an ounce of gold costs over seventy-five times more than an equal weight of silver. Why the huge difference? So why does gold demand a premium value over these other metals? What's the opportunity trading gold vs silver? Surprisingly, it is the fact gold is so. Gold is more expensive than platinum, yet we perceive platinum levels as more prestigious. Historically, gold and platinum have been very.

Platinum (Pt) is the rarest & the most precious of the 3. Platinum (Pt ) is currently around 50% more expensive than Gold. It is naturally white. So, to answer your question platinum as well as rhodium is more expensive than silver but cheaper than gold. And the higher the karat (18k. Live Precious Metal Prices More data. Share This Page. Live Precious Metal Prices. Live gold, silver, platinum, palladium spot prices from unvs.ru Silver Is Currently Cheaper than Gold: Per ounce, silver tends to be cheaper than gold, making it more accessible to small retail investors who. Gold has always been more expensive than silver, however if the ratio were to fall below 1 this would no longer be the case. This is not a fixed ratio, and. Gold has always been more expensive than silver, however if the ratio were to fall below 1 this would no longer be the case. This is not a fixed ratio, and. Platinum, while more expensive, is incredibly durable, hypoallergenic, and maintains its natural white color over time, making it ideal for those with active. Platinum is often priced higher than gold due to its rarity, but silver is more affordable for investors on a modest budget. Precious metals like gold, silver, and platinum have been recognized as valuable for a very long time. Learn about investing in these commodities. Historically, precious metals were important as currency but are now regarded mainly as investment and industrial raw materials. Gold, silver, platinum, and. Gold is more expensive than silver. Jewelry stores will often offer Gold is considered more scarce than silver, therefore, it is more expensive than silver. America's leader in precious metals investments where you can invest in gold, silver, platinum or palladium with confidence. Silver is one of the more affordable metals available, but it's usually more expensive than sterling silver because it's a more pure and high-quality item. Silver is one of the more affordable metals available, but it's usually more expensive than sterling silver because it's a more pure and high-quality item. Historically, precious metals were important as currency but are now regarded mainly as investment and industrial raw materials. Gold, silver, platinum, and. They get their rosy color by being mixed with a larger portion of copper than silver and zinc. Higher karat rose gold alloys will appear more peach since they. Its luster ranks as its most outstanding visual feature. Silver is also more abundant and much less expensive than gold or platinum. However, because silver. Precious metals have long been ranked by cultural hierarchy. For millennia, the king at the top of the castle - reigning over silver and gold - is platinum. One of the primary reasons that gold is more expensive than silver is the difference in the supply and demand dynamics between the two metals. Gold has a lower. Silver rings can be much more affordable than white gold rings - partly because of the quality of the gemstones or diamonds used in it. But the ability of.

Business Bookkeeping 101

Here are 10 basic types of bookkeeping accounts for a small business: · Cash. It doesn't get more basic than this. · Accounts Receivable. · Inventory. · Accounts. You must decide between single-entry and double-entry accounting when doing small business bookkeeping. All of your transactions are only ever recorded once. This guide will establish important definitions, offer tips on basic bookkeeping principles, introduce various financial options, and provide tips to get your. Every Business Owner should have a good understanding of bookkeeping basics! Whether you do your own bookkeeping at the end of the year or you pass your. Ever wonder how to do bookkeeping or how to track business expenses? Learn the basics so you will no longer ask yourself what is bookkeeping. Read this guide to learn how to help manage small business accounting and streamline your financial processes to ensure smooth operations. In this educational webinar Phyllis Johnson, owner & CEO of PKJ Consulting, will break down the bookkeeping process into simple terms. Define accounting and the concepts of accounting measurement. Explain the role of a bookkeeper and common bookkeeping tasks and responsibilities. Bookkeeping best practices · Accuracy—The correct data must be recorded. · Reliability—Data must be recorded in the proper place. · Timeliness—Data should be. Here are 10 basic types of bookkeeping accounts for a small business: · Cash. It doesn't get more basic than this. · Accounts Receivable. · Inventory. · Accounts. You must decide between single-entry and double-entry accounting when doing small business bookkeeping. All of your transactions are only ever recorded once. This guide will establish important definitions, offer tips on basic bookkeeping principles, introduce various financial options, and provide tips to get your. Every Business Owner should have a good understanding of bookkeeping basics! Whether you do your own bookkeeping at the end of the year or you pass your. Ever wonder how to do bookkeeping or how to track business expenses? Learn the basics so you will no longer ask yourself what is bookkeeping. Read this guide to learn how to help manage small business accounting and streamline your financial processes to ensure smooth operations. In this educational webinar Phyllis Johnson, owner & CEO of PKJ Consulting, will break down the bookkeeping process into simple terms. Define accounting and the concepts of accounting measurement. Explain the role of a bookkeeper and common bookkeeping tasks and responsibilities. Bookkeeping best practices · Accuracy—The correct data must be recorded. · Reliability—Data must be recorded in the proper place. · Timeliness—Data should be.

Intro Bookkeeping is an essential part of running any business, big or small. It involves keeping track of financial transactions. Small Business Bookkeeping Basics Tips · Separate Business and Personal Finances: Open a dedicated business bank account and credit card to avoid confusion and. Bookkeeping Basic Bookkeeping For a Small Business To ensure your finances make sense, bookkeeping is a vital part of small business operations. As a. Buy Accounting Bookkeeping for Small Business Made Simple. How Accountants manage their Analyst Role in Solving business problems. Small-Business Bookkeeping Basics · 1. Choose your bookkeeping method · 2. Set up your general ledger · 3. Create your business accounts · 4. Record every. business finances, managing transactions, tracking deadlines, and automating supplier interactions — Bookkeping ! The Small Business Bookkeeping Guide. unvs.ru: Bookkeeping For Business Professionals: Increase Your Accounting Skills And Create More Financial Stability And Wealth: Horne. Bookkeeping for Business Professionals: Increase Your Accounting Skills and Create More Financial Stability and Wealth (Paperback). Learn the basics of bookkeeping from Mohave Community College Small Business Development Center expert, Lisa Card. Gain a better understanding of your role. 4. Single-Entry Bookkeeping · Cash Disbursements Journal – Where you record the expenses the business pays for · Cash Sales Journal – Where you record the. Wave Accounting is a free platform that provides the basics on a cloud based platform. It sounds perfect for you. You can do your own. business finances, managing transactions, tracking deadlines, and automating supplier interactions — Bookkeping ! The Small Business Bookkeeping Guide. Get the essential bookkeeping tips for a starting entrepreneur. See the accounting lay of the land before starting your new business and possibly your life's. 3. Basic Types of Bookkeeping You Should Know · Cash: The account where all business transactions pass. · Accounts Receivable: If your business sells products or. The biggest thing is bookkeeper does is the monthly reconciliation of accounts and financial reports that help the business owner understand the. It's the process of systematically recording, organizing, and maintaining financial transactions and records of a business or individual. Bookkeeping is focused. Bookkeeping is the process of tracking all of your company's financial transactions, so you can see exactly where your business is spending money, where your. This bookkeeping guide gives you 10 steps to kick-start you, a new self-employed freelancer or business owner, to track your money with the right systems. Bookkeeping is simply another word for record-keeping – specifically, keeping records of all the financial transactions of a company or individual.

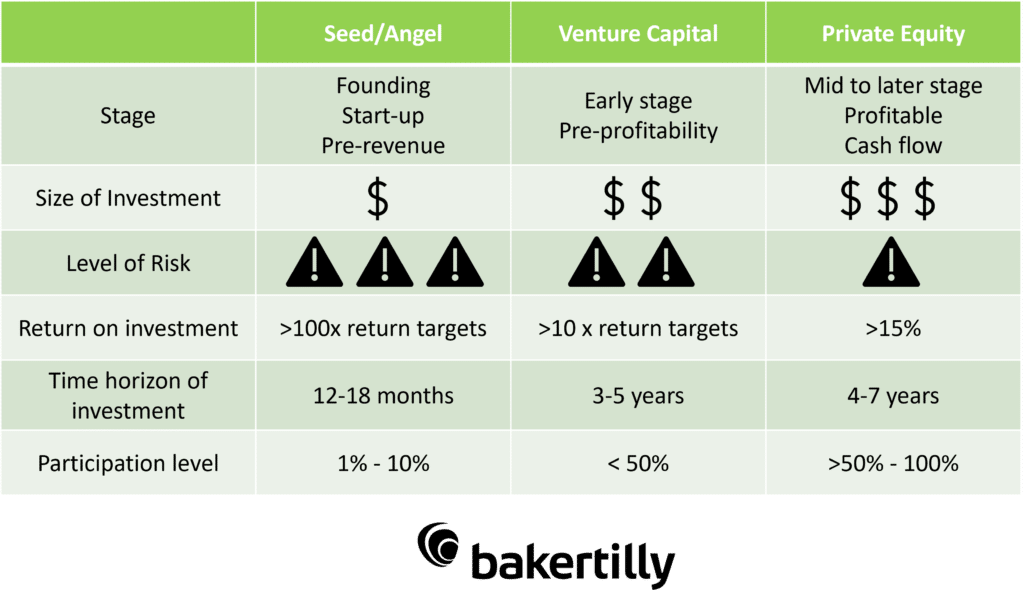

Vc Versus Private Equity

Private equity is typically invested in more established companies that are looking to expand or restructure. Venture capital firms tend to be. Here, we delve into a comparative analysis of the due diligence processes in VC and PE, underscoring the nuanced differences and key commonalities. Difference #1: Company Types. VCs do tend to focus on technology and life sciences, and PE firms do tend to invest in a wider set of industries. However, VCs. Private equity firms invest in established companies with stable cash flows, making them less susceptible to market volatility. Venture capital, on the other. Private equity firms also use both cash and debt in their investment, whereas venture capital firms deal with equity only. These observations are common cases. Private equity (PE) and Venture Cap (VC) both describe investing in relatively new companies, but VCs usually look for a quick return, while PEs generally. Venture capital firms invest in 50% or less of the equity of the companies. Most venture capital firms prefer to spread out their risk and invest in many. Private equity investments are typically in larger, more mature businesses with proven financial record. Further differentiating traits include: Risk – VC. Generally speaking, those who work in private equity earn more than venture capitalists. This is because the fund sizes are much larger in private equity. Private equity is typically invested in more established companies that are looking to expand or restructure. Venture capital firms tend to be. Here, we delve into a comparative analysis of the due diligence processes in VC and PE, underscoring the nuanced differences and key commonalities. Difference #1: Company Types. VCs do tend to focus on technology and life sciences, and PE firms do tend to invest in a wider set of industries. However, VCs. Private equity firms invest in established companies with stable cash flows, making them less susceptible to market volatility. Venture capital, on the other. Private equity firms also use both cash and debt in their investment, whereas venture capital firms deal with equity only. These observations are common cases. Private equity (PE) and Venture Cap (VC) both describe investing in relatively new companies, but VCs usually look for a quick return, while PEs generally. Venture capital firms invest in 50% or less of the equity of the companies. Most venture capital firms prefer to spread out their risk and invest in many. Private equity investments are typically in larger, more mature businesses with proven financial record. Further differentiating traits include: Risk – VC. Generally speaking, those who work in private equity earn more than venture capitalists. This is because the fund sizes are much larger in private equity.

A comparison of private equity and venture capital reveals notable differences in areas such as risk appetite, company stages, control, and ownership. Venture capitalists often invest in smaller ownership stakes compared to PE firms, allowing founders to maintain control of their companies. VC. The major distinction between growth equity and venture capital is the stage of company development. Private Equity, investment is invested to expand a mature business, whereas, Venture Capital, investment is invested in the early stage to develop a. Private equity firms tend to buy well-established companies, while venture capitalists usually invest in startups and companies in the early stages of growth. Exit strategy: Private equity firms generally aim to sell the companies they turn around, while VC firms tend to have more flexibility with their exit strategy. Unlike VC firms, PE firms often take a majority stake—50% ownership or more—when they invest in companies. Private equity firms usually have majority ownership. Private Equity, investment is invested to expand a mature business, whereas, Venture Capital, investment is invested in the early stage to develop a. Here, we delve into a comparative analysis of the due diligence processes in VC and PE, underscoring the nuanced differences and key commonalities. Private equity, on the other hand, focuses on investing in more mature companies to facilitate growth or restructuring. Both types of investment play a. Operational Involvement. A venture capital firm is involved in the operational process of a startup by advising about the right strategies to grow and become . In this article, we will compare private equity, venture capital, and hedge funds to help investors understand their key similarities and differences. Venture Capital funds invest in young, early-stage businesses and Private Equity (ie LBO) funds invest in mature, late-stage businesses. Private equity is often cheaper than VC investment, But venture capital investments give companies access to expertise and networks that may be able to help. Aspect, Private Equity, Venture Capital ; Investment Focus, More mature, established companies, Early-stage, high-growth potential companies ; Investment Size. This guide provides a detailed comparison of private equity vs. venture capital vs. angel and seed investors. Venture capital tends to be the best financing vehicle for fresh seed and early-stage startups, while venture debt can be better suited for more mature. From Angels to Venture Capitalists and Private Equity, we'll give you a breakdown of the differences between these types of tech and startup investors. Venture Capital funds invest in young, early-stage businesses and Private Equity (ie LBO) funds invest in mature, late-stage businesses. Private Equity and Venture Capital are two sides of the same coin – VC funds are, in fact, part of the Private Equity area. Private capital is also invested.

Whats The Cheapest Car Insurance

Our data indicated USAA, GEICO and Nationwide were the cheapest insurance companies in California's Low Cost Auto (CLCA) Insurance Program is a state-sponsored What are the cost for a CLCA policy? The annual premiums in California. The cheapest car insurance rates start at $39 per month and the most affordable companies with nationwide availability are USAA, Travelers, and Geico. Find cheap car insurance rates from The General®. Get a car insurance quote today and find affordable insurance coverage for your driving needs. Need car insurance? USAA offers competitive rates, discounts and exceptional service to military members and their families. Get an auto quote today. To help you find the cheapest car insurance in Ohio WalletHub collected quotes from all major auto insurers in Ohio. Are you looking for cheap auto insurance but worried about sacrificing quality and service in favor of a more affordable rate? GEICO has you covered. What are the risks of cheap car insurance? While cheap car insurance may save money upfront, it's important to consider potential risks, such as inadequate. Based on our research, Auto-Owners offers the cheapest minimum coverage car insurance rates for high-risk drivers who have one speeding ticket conviction. Our data indicated USAA, GEICO and Nationwide were the cheapest insurance companies in California's Low Cost Auto (CLCA) Insurance Program is a state-sponsored What are the cost for a CLCA policy? The annual premiums in California. The cheapest car insurance rates start at $39 per month and the most affordable companies with nationwide availability are USAA, Travelers, and Geico. Find cheap car insurance rates from The General®. Get a car insurance quote today and find affordable insurance coverage for your driving needs. Need car insurance? USAA offers competitive rates, discounts and exceptional service to military members and their families. Get an auto quote today. To help you find the cheapest car insurance in Ohio WalletHub collected quotes from all major auto insurers in Ohio. Are you looking for cheap auto insurance but worried about sacrificing quality and service in favor of a more affordable rate? GEICO has you covered. What are the risks of cheap car insurance? While cheap car insurance may save money upfront, it's important to consider potential risks, such as inadequate. Based on our research, Auto-Owners offers the cheapest minimum coverage car insurance rates for high-risk drivers who have one speeding ticket conviction.

Of the cars we reviewed, the Subaru Outback is the cheapest vehicle to insure, with an average annual premium of $1, per year, 25 percent lower than the. Minimal Coverage – only pay for what is required by Ontario law and nothing more. If you make these changes, the benefit is that you are lowering your. What are the Mandatory Car Insurance Requirements in Texas? Check with an independent car insurance company to find the cheapest car insurance quotes. Compare car insurance quotes from the top auto insurance carriers and get our best rates for the coverage you need. Liberty Mutual offers one of the widest selections of discounts of any car insurance company. Start your quote to find out how many you qualify. What is the best way for me to compare car insurance quotes? It's no secret that the cost of car insurance can be expensive, especially for young drivers. But. State Farm offers many coverage options, from auto insurance for teen drivers to rental cars and more. Switch and save an average of $ Auto-Owners has the cheapest liability-only quotes for teen drivers, at $58 monthly. Car insurance costs are higher than ever; it's not just in your head. Rates. See which cars are the cheapest and the most expensive when it comes to car insurance. Three Maseratis are the priciest and the cheapest are Hondas and. Liability insurance is usually the cheapest level of car insurance because it only covers the costs of injuries and damages for the other vehicle if you are at. Costco insurance program is the cheapest for sure, they go through American Family Insurance. I'm paying under $90/month for max coverage on a newer sports car. Auto Insurance Rates Are You Getting the Best Deal on Insurance? ; Liberty Mutual, $ ; Nationwide, $ ; State Farm, $ ; Travelers, $ Auto insurance rates are high but these companies can make covering your vehicle more affordable. What is the Fine for Driving Without Insurance in Ontario? As most people know, driving without insurance anywhere in Canada is against the law. In fact, if you. Cheapest car insurance in Calgary now with Sharp insurance, One of the best car insurance brokers in Calgary, AB. Affordable for your needs. The best way to get cheap car insurance is to compare quotes from several inexpensive insurers, as you will be able to select the lowest price for the coverage. affordable auto insurance without having to wait for your 25th birthday. What is the cheapest car insurance for young drivers? To find the cheapest insurance. We analyzed the rates of best-selling cars, trucks and SUVs to find out which popular cars have the cheapest car insurance rates. Progressive car insurance customers qualify for an average of seven discounts, which means your savings could stack up without ever decreasing your coverage. What are the cheapest cars to insure? · Subaru Ascent · Subaru Forester · Honda Passport · Hyundai Palisade · Volkswagen Atlas · Kia Telluride.

Who Can Open Joint Bank Account

What information do I need to open a joint account? You can apply for a joint bank account online. You will need both party's information. To apply for a joint account, please visit our Checking page and click. Generally, one account holder can make that choice, though some banks require consent from both parties. Check your account agreement for details. You should. Joint accounts offer a new level of convenience and flexibility for the account holders that weren't possible before. Many joint banking accounts are started by. open to your Sources: [1] When to Consider Opening a Joint Checking Account, Nerd Wallet [2] Should You Have Joint or Separate Bank Accounts?, About. A joint account is a bank account that has been opened by two or more individuals or entities. Joint accounts are commonly opened by close relatives or by. Yes. I did this with Ally -- you first open a new account with an individual owner, and then send in a form (along with copies of identification). Photo ID. Social Security number. Proof of address. Other general information, such as birth dates. Opening deposit (in some cases). You may want more than one individual on your checking account. Huntington explains how you can add a person to your account at any time or open a joint. What information do I need to open a joint account? You can apply for a joint bank account online. You will need both party's information. To apply for a joint account, please visit our Checking page and click. Generally, one account holder can make that choice, though some banks require consent from both parties. Check your account agreement for details. You should. Joint accounts offer a new level of convenience and flexibility for the account holders that weren't possible before. Many joint banking accounts are started by. open to your Sources: [1] When to Consider Opening a Joint Checking Account, Nerd Wallet [2] Should You Have Joint or Separate Bank Accounts?, About. A joint account is a bank account that has been opened by two or more individuals or entities. Joint accounts are commonly opened by close relatives or by. Yes. I did this with Ally -- you first open a new account with an individual owner, and then send in a form (along with copies of identification). Photo ID. Social Security number. Proof of address. Other general information, such as birth dates. Opening deposit (in some cases). You may want more than one individual on your checking account. Huntington explains how you can add a person to your account at any time or open a joint.

If you and your significant other have decided on spending your life together, ask each other if you should combine your financials accounts now that you're. How to open a joint bank account · 1. Choose a financial institution · 2. Gather required documents · 3. Visit the institution or website · 4. Complete the. You can use this method to pay bills and other financial requirements for your aging parents. Your local bank can help you access the bank account with your and. How do I open a joint checking account? Joint checking accounts must be Access Banking account on or after the date of conversion will be returned unpaid. Most banks will allow you to sign up online or in person as long as you have the required information for both owners. You'll likely need. In most cases, banks and other financial institutions add an individual to an account as a joint owner, not an authorized signer. Assets that were managed. Opening a joint bank account is similar to setting up individual accounts. Most banks will allow you to sign up online or in person as long as you have the. A joint bank account could be vulnerable to your spouse's creditors, while leaving your precious dollars in an individual account can protect them. To start on. A joint account is a bank account that has been opened by two or more individuals or entities. Joint accounts are commonly opened by close relatives or by. To open a joint account, you'll need to provide proof of identification and proof of address. Depending on your bank, you may need to provide more than one. A joint bank account is an account in which two or more people have Why or when should I open a joint account? You may choose to open a joint. It's a bank account held by two or more people who share ownership of the funds in the account. How do they work? A Power of Attorney for Property allows. While not a requirement for opening a joint checking account, having a joint savings account is a great way for you and your partner to plan for the future. All checking accounts at Santander Bank can be opened jointly. Compare checking account options to determine which account fits your and your co-owner's needs. What about joint accounts? · Two or more individuals have access to the account · Each person can deposit, withdraw or transfer funds, regardless of who put them. While some couples will open an account and put all of their combined cash into it, other couples may choose to open up a shared bank account in addition to. A sudden drop in your parents' checking account funds could mean fraud is afoot or a scammer is involved. By monitoring transactions, you can stay on top of. Joint bank accounts can make money matters simpler and more convenient for everyday life. It may make sense to open one account together for shared expenses—. A joint bank account could be vulnerable to your spouse's creditors, while leaving your precious dollars in an individual account can protect them. To start on.

How To Keep A Good Credit Score Without Debt

Lenders generally want to see established lines of credit. This means that you should keep credit accounts open (even if you no longer use them) because closing. To help maximize your score, you will want to keep balances as far below your credit limit as possible. While there is no set rule on credit utilization ratios. How to Build Good Credit · Review your credit reports. · Get a handle on bill payments. · Use 30% or less of your available credit. · Limit requests for new credit. You may already be taking actions that affect your credit score without knowing it. Actions like paying your utility bill on time or keeping a low credit card. It's worth noting the credit scores sold to you by credit reference agencies may show you've a perfect score without being on the electoral roll. Don't let. Experian Boost is free to use, and makes it easy to connect accounts. All you have to do is sign up and link the credit card or bank account from which you pay. A key element in managing credit is understanding and optimizing your credit utilization, the ratio of your credit card balances to your credit limits. Review your credit report · Create a plan · Consider a debt consolidation loan or balance transfers to a lower rate credit card · Research working with a credit. But honestly, there's no 'quick fix' for any of it. The way to get a better credit score is to 1) consistently not have a ton of debt, 2) pay. Lenders generally want to see established lines of credit. This means that you should keep credit accounts open (even if you no longer use them) because closing. To help maximize your score, you will want to keep balances as far below your credit limit as possible. While there is no set rule on credit utilization ratios. How to Build Good Credit · Review your credit reports. · Get a handle on bill payments. · Use 30% or less of your available credit. · Limit requests for new credit. You may already be taking actions that affect your credit score without knowing it. Actions like paying your utility bill on time or keeping a low credit card. It's worth noting the credit scores sold to you by credit reference agencies may show you've a perfect score without being on the electoral roll. Don't let. Experian Boost is free to use, and makes it easy to connect accounts. All you have to do is sign up and link the credit card or bank account from which you pay. A key element in managing credit is understanding and optimizing your credit utilization, the ratio of your credit card balances to your credit limits. Review your credit report · Create a plan · Consider a debt consolidation loan or balance transfers to a lower rate credit card · Research working with a credit. But honestly, there's no 'quick fix' for any of it. The way to get a better credit score is to 1) consistently not have a ton of debt, 2) pay.

Get smarter about your credit and debt · Pay your bills on time Expand · Tip · Avoid maxing out credit accounts Expand · Tip · Manage your debt-to-income ratio. Aim to keep your balance low when the card issuer reports it to the credit bureaus, because this is part of the data used to calculate your credit score. 1. Never miss a bill due date. Paying your bills on time is the cardinal rule of maintaining a good credit score. · 4. Be cautious about new loan applications · 6. If you want to inch yours closer to , don't close one credit card when you get another. Keep cards open and use them once a month, just to show their active. Review your credit report · Create a plan · Consider a debt consolidation loan or balance transfers to a lower rate credit card · Research working with a credit. Other actions, such as making repayments to a federal loan under your name to applying for a phone line (if the phone company reports to credit bureaus) can. “maxed out” on credit cards. If you use too much of your credit limit, it may hurt your credit score. Some experts advise using no more than 30 percent of. Pay off delinquent bills. Paying down delinquent accounts won't remove missed payments from your report. But it can make you look better to creditors. Look for. What's a good credit score? There's no single answer to what a good credit score is. · 1. Review credit regularly · 2. Keep credit utilization ratio below 30% · 3. Lenders generally want to see established lines of credit. This means that you should keep credit accounts open (even if you no longer use them) because closing. Experts and the credit bureaus say that a good rule of thumb is to shoot for a utilization percentage under 30% This not only helps keep monthly bills low but. Aim to keep your balance low when the card issuer reports it to the credit bureaus, because this is part of the data used to calculate your credit score. You. Focus on meeting your existing credit card obligations such as paying your bill on time each and every month, staying within a reasonable credit utilization. Other actions, such as making repayments to a federal loan under your name to applying for a phone line (if the phone company reports to credit bureaus) can. Compare credit builder cards · 1. Get on the electoral roll · 2. Make sure your name is on household bills · 3. Take out a personal loan · 4. Repay outstanding. Don't apply for credit or switch credit cards too often.3 Make an effort to keep your total debt in check and don't let small balances add up It's always a good idea to keep up with your debt payments and repay what you owe. The long-term benefits to your credit scores and the ability to live debt-. If you can pay off your credit card balance in full each month, that helps. If you make your monthly mortgage payment every month without delay, that's huge. In. You can “fix” a bad credit score by paying bills on time, keeping credit card balances low and adding positive payment history to your credit report with a. Pay your cards off times per month instead of once per month to keep your balance low at any one time. If you make a major purchase, pay the card off right.

About Merrill Lynch

Merrill Edge offers a wide range of investment products and advice, including brokerage and retirement accounts, online trading, and financial research. Merrill Lynch is the foremost wealth management company with years of professional experience and knowledge help you reach your goals. Merrill Lynch is an American investment management and wealth management division of Bank of America. division. Merrill Edge was created to merge Bank of America Online Investing and Merrill Lynch's research, investment tools, and call center counsel. Learn about the benefits you can enjoy with investment solutions from Merrill and the full range of banking capabilities from Bank of America. Insurance and annuity products are offered through Merrill Lynch Life Agency Inc., a licensed insurance agency and wholly owned subsidiary of Bank of America. Merrill Lynch & Co. is the name of a prominent Wall Street investment firm that was acquired by Bank of America (BAC) in A Merrill advisor provides access to the investing insights of Merrill and banking capabilities of Bank of America to help you make informed decisions. Founded in , Merrill is one of the largest wealth management businesses in the world. Merrill financial advisors combine financial knowledge and. Merrill Edge offers a wide range of investment products and advice, including brokerage and retirement accounts, online trading, and financial research. Merrill Lynch is the foremost wealth management company with years of professional experience and knowledge help you reach your goals. Merrill Lynch is an American investment management and wealth management division of Bank of America. division. Merrill Edge was created to merge Bank of America Online Investing and Merrill Lynch's research, investment tools, and call center counsel. Learn about the benefits you can enjoy with investment solutions from Merrill and the full range of banking capabilities from Bank of America. Insurance and annuity products are offered through Merrill Lynch Life Agency Inc., a licensed insurance agency and wholly owned subsidiary of Bank of America. Merrill Lynch & Co. is the name of a prominent Wall Street investment firm that was acquired by Bank of America (BAC) in A Merrill advisor provides access to the investing insights of Merrill and banking capabilities of Bank of America to help you make informed decisions. Founded in , Merrill is one of the largest wealth management businesses in the world. Merrill financial advisors combine financial knowledge and.

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”) makes available certain investment products. Submit this contact form to speak to a Merrill Lynch financial advisor today and learn how you can work together to meet your financial goals. Merrill offers a broad range of brokerage, investment advisory (including financial planning) and other services. Additional information is available in our. Merrill Lynch is an American investment management and wealth management division of Bank of America. Learn about the benefits you can enjoy with investment solutions from Merrill and the full range of banking capabilities from Bank of America. Merrill Lynch & Co. is the name of a prominent Wall Street investment firm that was acquired by Bank of America (BAC) in Working independently, the lineage of our group dates back to when Merrill Lynch Wealth Management opened its Santa Barbara office. A formal team. Bank of America and BofA Securities (formerly Bank of America Merrill Lynch) provide global perspectives, comprehensive solutions and strategic guidance. Find and learn more about a financial advisor near you from the Merrill Lynch Wealth Management Branch Office in Lincoln, NE Merrill offers a broad range of brokerage, investment advisory (including financial planning) and other services. Additional information is available in our. Personalized investing with insights, guidance and tools to confidently put your investing ideas into action. Merrill offers a broad range of brokerage, investment advisory (including financial planning) and other services. There are important differences between. Merrill Lynch provides timely stats and strategies to help you pursue your financial goals. Follow us to get started. Disclosures: unvs.ru A complete timeline of Merrill Lynch's History from founding to present including key milestones and major events. Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”) makes available certain investment products sponsored, managed. Merrill offers a broad range of brokerage, investment advisory (including financial planning) and other services. With Bank of America banking and Merrill investing offering a range of solutions to help you manage your wealth, find the investment approach that fits your. Bank of America Merrill Lynch has launched Instinct Natural, an enhancement to its alternative trading system (ATS) Instinct X, aimed at increasing. Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”) makes available certain investment products sponsored. Trust and fiduciary services are provided by Merrill Lynch Trust Company, a division of Bank of America, N.A. Banking products are provided by Bank of America.

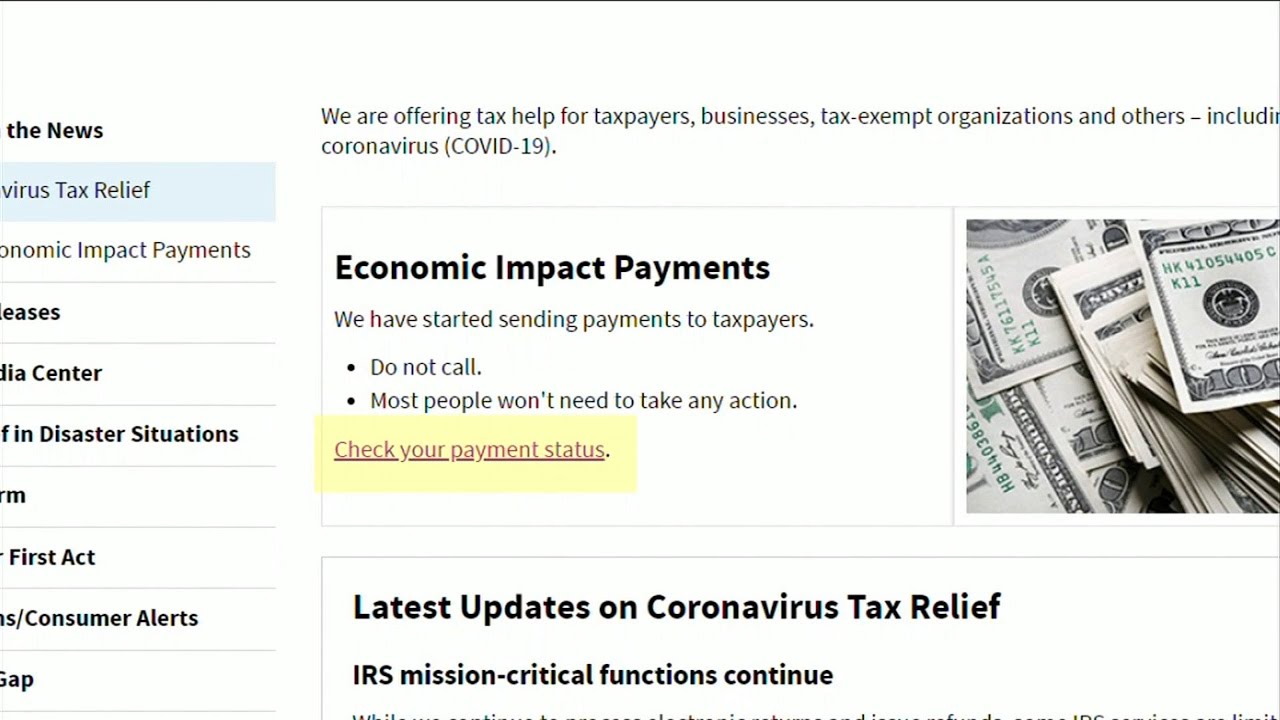

How Do I Check About My Stimulus Payment

Check your bank statements. If you had your payments direct deposited, you can find the amount of your first, second, and third stimulus check using your bank. For information on the third EIP, see the IRS EIP webpage. To check on the status of your EIP, go to the IRS Get my Payment webpage. What are the differences. To check the status of your Economic Impact Payment, please visit the IRS Get my Payment page · To check if you qualify for the Economic Impact Payment this. Check Payment Status · Stimulus Payment Not Received. If your status shows your third stimulus payment was issued but you still haven't received it, you can. If the IRS already has your account information and you still have not received the stimulus money, or you would prefer to receive your payment by paper check. You can check the status of your Economic Impact Payment and learn more using the "Get My Payment Tool from unvs.ru Help is here, and we want to get this. You can start a payment trace by calling the IRS at Or mail or fax a completed Form , Taxpayer Statement Regarding Refund, to the IRS. The IRS created a Get My Payment portal so you can learn the status of your payment. To report missing checks or ask other questions, call the IRS at. Find out how to track the latest stimulus check using the IRS's Get My Payment app, and learn what to do if you encounter any problems. Check your bank statements. If you had your payments direct deposited, you can find the amount of your first, second, and third stimulus check using your bank. For information on the third EIP, see the IRS EIP webpage. To check on the status of your EIP, go to the IRS Get my Payment webpage. What are the differences. To check the status of your Economic Impact Payment, please visit the IRS Get my Payment page · To check if you qualify for the Economic Impact Payment this. Check Payment Status · Stimulus Payment Not Received. If your status shows your third stimulus payment was issued but you still haven't received it, you can. If the IRS already has your account information and you still have not received the stimulus money, or you would prefer to receive your payment by paper check. You can check the status of your Economic Impact Payment and learn more using the "Get My Payment Tool from unvs.ru Help is here, and we want to get this. You can start a payment trace by calling the IRS at Or mail or fax a completed Form , Taxpayer Statement Regarding Refund, to the IRS. The IRS created a Get My Payment portal so you can learn the status of your payment. To report missing checks or ask other questions, call the IRS at. Find out how to track the latest stimulus check using the IRS's Get My Payment app, and learn what to do if you encounter any problems.

Those with questions can call the stimulus check hotline at IRS Get My Payment Tool. Get your payment status. See your payment type. Provide. See the special section on unvs.ru for more information. Free tax return preparation is also available for qualifying individuals. You can visit the IRS website. Some people will get their check automatically. Others will have to register with the IRS. Eligible adults, who have not yet registered or received their. View All Federal Refund Offset - TOP, Individual Income Tax FAQs. Whom should I contact regarding the offset of my stimulus payment(s) or Social Security. You can check when and how your payment was sent with the Get My Payment tool. If you have questions about the Get My Payment tool, visit the IRS Get My Payment. While you may have heard them referred to as stimulus checks, the Economic Impact Payments were, for the most part, direct deposited into bank accounts or. Eligible individuals should use the Get My Payment tool to find out when and how the EIP3 was sent. Please note the payment status for the first and second. Check the IRS Get My Payment web tool for determining whether your stimulus payment has been issued. Read answers to frequently asked questions about stimulus. If you do not have prior tax returns on file, you will need to file a income tax return to receive the third stimulus check – even if you have no income to. If you're expecting a Coronavirus stimulus check, the Get My Payment tool provided by the IRS may be a helpful resource. Use it to check the status of your. See the special section on unvs.ru for more information. Free tax return preparation is also available for qualifying individuals. You can visit the IRS website. Eligible people who filed taxes for or should get a payment automatically, either by direct deposit or check mailed to the address on file with the. Eligible people who filed taxes for or should get a payment automatically, either by direct deposit or check mailed to the address on file with the. Visit unvs.ru for more information on Economic Impact Payments. EIP Card. Curious about how you can use your EIP Card, transfer funds, get cash or obtain. Here are some important facts regarding your child support and the federal stimulus payment.2nd and 3rd Stimulus Payments (COVID Relief Bill) Your 2nd. Find information about the Economic Impact Payments (stimulus checks), which were sent in three batches over and Check the status of your Internal. To find the amount of Economic Impact Payments issued to you on record, you may create or visit your IRS Online Account. In July of , many eligible families. How do I find out if the IRS is sending me a payment? People can check the status of both their first and second payments by using the Get My Payment tool. Do not check with your bank prior to 5 days after the payment date or your online account shows your payment amounts because the bank may not have any. If you don't make enough income to have to file taxes, you may miss out on the federal STIMULUS check, also known as the Economic Impact Payment.

Blackrock Aladdin Price

BlackRock AI Coin price is $ ALADDIN's market cap is $9K and its 24h trading volume is $0. Get real-time crypto data now! BlackRock's Aladdin Gets Smarter: $B Deal Adds Preqin's Private Markets Data. Jul 1, PDT. BLK · FDFFNNITE. BlackRock, Inc. BLK plans to acquire. Aladdin is an electronic system built by BlackRock Solutions, the risk management division of the largest investment management corporation, BlackRock. Integral provides pre-trade cost savings analysis using real-time market rates to help traders choose the optimal netting plan; Aladdin populates all of the. Find the top alternatives to Aladdin by BlackRock currently available. Compare ratings, reviews, pricing, and features of Aladdin by BlackRock alternatives. Over the last 12 months, its price rose by percent. Looking ahead, we forecast BlackRock to be priced at by the end of this quarter and at Find out more about BlackRock Aladdin starting price, setup fees, and more. Read reviews from other software buyers about BlackRock Aladdin. Interested parties will have to get in touch with the Addepar team to nail down exactly what it'll cost them to use the platform. Aladdin by BlackRock: Risk. Blackrock says clients use the platform (compared to for Bloomberg AIM), which means the average AuM of an Aladdin client is $bn. BlackRock AI Coin price is $ ALADDIN's market cap is $9K and its 24h trading volume is $0. Get real-time crypto data now! BlackRock's Aladdin Gets Smarter: $B Deal Adds Preqin's Private Markets Data. Jul 1, PDT. BLK · FDFFNNITE. BlackRock, Inc. BLK plans to acquire. Aladdin is an electronic system built by BlackRock Solutions, the risk management division of the largest investment management corporation, BlackRock. Integral provides pre-trade cost savings analysis using real-time market rates to help traders choose the optimal netting plan; Aladdin populates all of the. Find the top alternatives to Aladdin by BlackRock currently available. Compare ratings, reviews, pricing, and features of Aladdin by BlackRock alternatives. Over the last 12 months, its price rose by percent. Looking ahead, we forecast BlackRock to be priced at by the end of this quarter and at Find out more about BlackRock Aladdin starting price, setup fees, and more. Read reviews from other software buyers about BlackRock Aladdin. Interested parties will have to get in touch with the Addepar team to nail down exactly what it'll cost them to use the platform. Aladdin by BlackRock: Risk. Blackrock says clients use the platform (compared to for Bloomberg AIM), which means the average AuM of an Aladdin client is $bn.

BlackRock AIPrice Now. BlackRock AI Token price now is $ with a 24h volume of $0. BlackRock AI is up 0% in the last 24h. BlackRock AI Market Cap is. The current price of ALADDIN (ALADDIN/WETH) on Uniswap V2 is $, the price is up 0% in the last 24 hours. Its hour trading volume is reported to be. cost. Read more about it below. View profile for Michael Kitces, graphic. Michael Kitces. Chief Financial Planning Nerd. 9mo. ICYMI: Reaping. Aladdin is the brainchild of BlackRock founder Larry Fink, which is the largest shadow bank in the world and the most powerful company on Earth. Larry got his. What are we talking about in terms of cost for Aladdin suite? Are BBTs still $2K/mo? Compare the best Aladdin by BlackRock alternatives in Explore user reviews, ratings, and pricing of alternatives and competitors to Aladdin by. The Aladdin Blockchain Technologies Holding SE stock price today is What Is the Stock Symbol for Aladdin Blockchain Technologies Holding SE? The stock. How much does BlackRock's Aladdin Wealth Management software cost? Aladdin What is the price of Aladdin used by BlackRock? I don't have real. HSBC signs deal to use BlackRock's 'Aladdin' software worldwide You can select between four sizes and each price varies according to the size— RM13, RM BNY Data Insights and Digital Applications on BlackRock Solutions' Aladdin® pricing correctly. NAV Single Fund Impact: View and compare detailed. Aladdin is a tool to help your organization communicate effectively, address problems quickly, and make informed decisions at during the investment process. The pricing for Aladdin starts at $ per user per month. Aladdin has 3 different plans: Professional at $ per user per month. Business at $ per. Two of the leading front-to-back office platforms for investment managers are BlackRock's Aladdin and SimCorp Dimension (rebranded to SimCorp One). But how do. Fast forward to today, Aladdin oversees assets worth more than $20 trillion for over clients, contributing around $ billion in revenue. Aladdin Professional: $45/user/month. Additional implementation fees apply. Tabset anchor. Aladdin Features. What solutions does Aladdin provide? What is Aladdin? Aladdin is portfolio management software from BlackRock. The platform provides investment managers with a unified data language to gain. The Portfolio Risk Platform leverages Aladdin, Blackrock's state-of-the-art Those costs will be included in the net price of the security, not separately. BlackRock cost of goods sold for the twelve months ending June 30, was $0M, a NAN% increase year-over-year. BlackRock annual cost of goods sold for And the firm's Carbon Beta tool was allowing managers to stress-test portfolios against various carbon pricing scenarios. BlackRock's Aladdin platform to. StateStreet has a product TMan (short for trade management), which comes close to, but not as good as, Aladdin. It handles various finance.

Top Ten Dividend Stocks

This is a real-time list of all stocks, ETFs and funds yielding more than 4%. See our GUIDE to high yield investing below. My goal is to buy high-yield dividend stocks that maintain stock value and maintains a dependable dividend income. View a list of TSX and TSXV stocks with the highest dividend yields. The S&P High Dividend Index serves as a benchmark for income seeking equity investors. The index is designed to measure the performance of 80 high yield. Seeking Alpha's high dividend stocks ideas and analysis from the largest community of dividend investors. Read in-depth content from our skilled authors. How do I invest in dividend stocks worldwide? · Indices on Global Dividend Stocks compared · FTSE All-World High Dividend Yield index · MSCI World High Dividend. Arm & Hammer, OxiClean and Waterpik are just a few examples among dozens of its household brands. Church & Dwight was founded in and is today the leading. You can use Barchart's Top Dividend Stocks list to identify today's stocks paying the highest annual dividend yield. Futures and Forex: 10 or 15 minute delay. Our team screened thousands of stocks to find the best dividend stocks of We based our selection on the following factors: an attractive valuation. This is a real-time list of all stocks, ETFs and funds yielding more than 4%. See our GUIDE to high yield investing below. My goal is to buy high-yield dividend stocks that maintain stock value and maintains a dependable dividend income. View a list of TSX and TSXV stocks with the highest dividend yields. The S&P High Dividend Index serves as a benchmark for income seeking equity investors. The index is designed to measure the performance of 80 high yield. Seeking Alpha's high dividend stocks ideas and analysis from the largest community of dividend investors. Read in-depth content from our skilled authors. How do I invest in dividend stocks worldwide? · Indices on Global Dividend Stocks compared · FTSE All-World High Dividend Yield index · MSCI World High Dividend. Arm & Hammer, OxiClean and Waterpik are just a few examples among dozens of its household brands. Church & Dwight was founded in and is today the leading. You can use Barchart's Top Dividend Stocks list to identify today's stocks paying the highest annual dividend yield. Futures and Forex: 10 or 15 minute delay. Our team screened thousands of stocks to find the best dividend stocks of We based our selection on the following factors: an attractive valuation.

Top High Dividend Yield Stocks Top High Dividend Stocks. © Macrotrends LLC | Terms of Service | Privacy Policy | Contact. Top Highest Dividend Yield ETFs ; YYY · Amplify High Income ETF, % ; AMZP · Kurv Yield Premium Strategy Amazon (AMZN) ETF, % ; FTQI · First Trust. Tracks common stocks of US companies that have paid above-average dividends for the previous 12 months, excluding REITs. The basic materials sector presents a high overall dividend yield, primarily propelled by the Oil and Gas Drilling & Exploration and Industrial Metals & Mining. Highest Dividend Stocks. Chevron (CVX) International Business Machines (IBM) and Altria Group (MO) are some of the most trending Dividend Stocks. See how they. Check out stocks offering high dividend yields along with the company's dividend history. You can view all stocks or filter them according to the BSE group or. World's companies with the highest dividend yields ; RRHI · D · ASX, %, AUD ; ELRN · D · TASE, %, ILA. Or a company may seem to offer a high dividend yield simply because it recently experienced a price decline. If your goal is creating an income stream, you. The MSCI High Dividend Yield Indexes aim to reflect the opportunity set of companies with high dividend income and quality characteristics that pass dividend. dividend-paying stocks with strong financial health: 1. Don't chase high dividend yields. "There's a reason—and not always a good one—that a security is. Highest Dividend Yield Shares · 1. Taparia Tools, , , , , , , , , , , · 2. C P C L, , Vanguard High Dividend Yield ETF (VYM) - Find objective, share price, performance, expense ratio, holding, and risk details. Most Recent Earnings of Top Dividend Stocks ; ENB. Enbridge. Aug 02, · · ; CM. Canadian Bank of Commerce. Aug 29, · · ; KEY. Keyera Corp. Top Blue Chip Dividend Stocks to Invest in for the Long Term · Combining blue chip stock quality with dividends · Best blue chip dividend stocks of · 1. Apple. Best Dividend Stock to Buy for Passive-Income Investors: Scotiabank vs. Enbridge. August 28, | Amy Legate-Wolfe. Both offer major dividends, but which is. Canadian companies with the highest dividend yields ; NEO · D · %, CAD ; TPZ · D · %, CAD ; VRN · D · %, CAD ; SECU · D · %, CAD. Some dividend stocks overdeliver and outperform the stock market. Investing in these stocks can help you beat the stock market, maintain high cash flow and. Top Dividend Stocks: Western Midstream's Jaw-Dropping % Yield Entices At an % annualized yield, Western Midstream is well above the 5% of a two-year. 5 Canadian dividend stocks worth investing in · Bank of Nova Scotia, Toronto symbol BNS · Canadian National Railway, Toronto symbol CNR · Imperial Oil Ltd. Shareholders invest in dividend-paying stocks with the understanding that dividend payments rely on ongoing profitability and can fluctuate depending on.